Swapping debt for nature or climate is in effect a spatiotemporal transformation of debt (“shapeshifting”) by way of which powerful elites monetize the environment and socialize the consequences from its appropriation or its destruction. They extract the gains and shift the burden of state duties to ordinary citizens.

Debt-for-climate swaps are hailed in the global discourse of climate and development finance for the prospect of hitting “two birds with one stone”: tackling the “debt crisis” and promoting climate action in the global South (Essers et al., 2021; Singh/Widge, 2021); a win-win-win for funders, development, and the environment (Steele/Patel, 2020; Yue/Wang, 2021).

They are not a novelty. Starting in the 1980s, debt-for-nature swaps have been used to convert a country’s debt obligation into environmental projects. The problem: by driving the privatization, commodification, and marketization of nature, these schemes generate or amplify environmental conflict (Chantada, 1992; McAfee, 1999; Kay, 2017). In the Dominican Republic, for example, such a debt swap made way for conservation—initiated by international elites, internalized by national elites—that fuelled conflict over resources and resulted in the displacement of residents.

Ecologically, debt swaps are neither necessary nor sufficient. They do not strengthen policies (Patterson, 1990). Funds could be spent directly for the environment—debt could be forgiven without such technofixes (Occhiolini, 1990; Bracking, 2021; Brodbeck et al., 2022). Their existence hints at implicitly political and capitalist motives. A local activist puts it this way: “Debt swaps for nature are nothing more than small instruments through which neoliberal policies try to manage nature by discrediting the State” (Chantada, 1992).

In this essay, I explore the power relations in a debt-for-nature swap arrangement that resulted in environmental injustices in the Dominican Republic (DR). The case is interesting because locals managed to fend off international conservationists, not conservation itself. First, I analyse the ways in which the exchange of debt for nature in the DR fuelled natural conservation, at who’s expense and in who’s favour. Then, I examine the power struggles, i.e., the depoliticized and politicized repercussions, this has triggered. Concepts of green developmentalism and political economy aid the analysis of the forces in the monetization of nature and its contestation. This topic is important because insights about how earlier swap arrangements led to environmental injustices and were contested can point to potential harmful effects of the latest generation of debt-for-climate swaps.

Background

Debt Swaps

In a dept-for-nature or climate swap, part of a country’s debt obligation is exchanged for a commitment to an environmental protection project (Dogse/Droste, 1990; Singh/Widge, 2021). Debt swaps emerged in the 1980s. The then-prevailing “debt crisis” and “environmental crisis” created a vicious cycle in the “third world”. The World Wildlife Fund suggested to convert unsustainable parts of debt into environmental actions in poorer countries (Patterson 1990; Thapa, 1998; Burnett 2016). They were first used in Bolivia, Ecuador, Costa Rica, and the DR starting in 1987 (Patterson, 1990). In this context, debt swaps are seen as „mechanisms for investing in conservation and sustainable development“ (Dogse/Droste, 1990, p.9). However, these arrangements do not mobilize additional funds for the country.

There are variations in swaps (cf. Dogse/Droste, 1990). Typically, they involve a sponsor—a powerful international conservation NGO (Igoe/Brockington, 2007; Holmes, 2010). It purchases parts of a country’s debt papers denoted in US dollars on the open market, e.g., from commercial banks. They trade at a significant discount. The debt papers are returned to the country’s central bank. It retires them and, in exchange, issues a new commitment: it is smaller than the old debt, larger than the sponsor’s investment (Patterson 1990; Bolton et al., 2022; OECD, 2007; Yue/Wang, 2021); it funds a local NGO over the period of an environmental project (Patterson 1990; Rosebrock/Sondhof 1991). That NGO can be affiliated with the sponsor.

Debt-for-climate swaps work similarly. The discourse emerged in the light of country pledges for climate action and exorbitant debt levels in the global South (Brodbeck et al., 2022; UNEP, 2022). It suggests meeting, once again, a double bottom line: enabling resilient development in poorer countries and protecting the climate—prospectively in exchange for carbon offsets (Rambarran, 2018; Silver/Campbell, 2018; Steele/Patel, 2020; Essers et al., 2021; Thomas/Theokritoff, 2021; Chamon et al., 2022; Owen, 2022).

Some criticize debt swaps for undermining the state, not strengthening local capacities, adding to inflation, or their limited impact on development (Hansen, 1989; Bedarff et al., 1989; Hawkins, 1990; Patterson 1990; Dogse/Droste, 1990; Thapa, 1998; Lewis, 1999; Cassimon et al., 2011). Others criticise the conservation and the financing of it for reasons of fuelling the neoliberalization of nature, green colonialism or territorialization and extractivism, for displacing people, and violating human rights (Bedarff et al., 1989; Hawkins, 1990; Goldman 2001; Igoe/Brockington, 2007; Hassoun, 2012; Kay, 2017; Bracking, 2019).

Green Developmentalism

The Dominican swap amplified inequalities—a process that is revealed through criticism of green developmentalism. McAfee (1999) helps to understand the powers involved in the privatization, commodification, and marketization of nature. Her critique lends itself for the analysis of conservation enabled by a financial construct.

Green developmentalism represents the institutions, discourses, and practices that contribute the rules, methods, and structures to create global markets in natural commodities and services. It hides the political, promotes technofixes, and strengthens power imbalances. In this vein, “green developmentalism reinforces environmental injustice on a world scale.” (McAfee, 1999, p.135) It rationalizes capitalism’s role in conservation in the first place and for as long as it pays. Environmental economics justifies the monetization and trading of natural resources. In effect, environmentalism serves capitalism. Accordingly, environmental protection is financed by extracting gains from ecotourism, ecosystem services, pollution permits, etc. (McAfee, 1999; Kay, 2017). Green developmentalism is aided by the interplay of the discursive power of this kind of paradigm, institutional powers in environment and development, and economic powers of states and organizations (McAfee, 1999; cf. Goldman, 2001; Igoe/Brockington, 2007; Brockington/Duffy, 2010; Kay, 2017).

Environmental Justice and the Political Economic Process

Conservation in the DR was contested between social movements, capitalists, and political elites—the interplay becomes clearer through a political economy lens. Pellow (2001) finds that the state’s authority has diminished and argues for taking on a wider perspective in environmental justice issues. His framework helps to make sense of the power struggles between movements, powerful organizations, and the state. Given the trade liberalization during the 1980s and 90s, state sovereignty has declined. Capitalists filled the void and influence policymaking. Economic powers have globalized, while the state and civil society have not (Pellow, 2011). Although this analysis concerns the US, parallels in the DR case make the framework compelling.

Injustices from Swapping Debt for Nature: International Powers Fuelling Conservation

Outcomes

The first debt-for-nature swap in the Dominican Republic in 1990 gave way for four state-sponsored conservation projects. They were characterized by privatization, tax evasion, eco-tourism, and exploitation. They led to displacement and ecological degradation. Some examples:

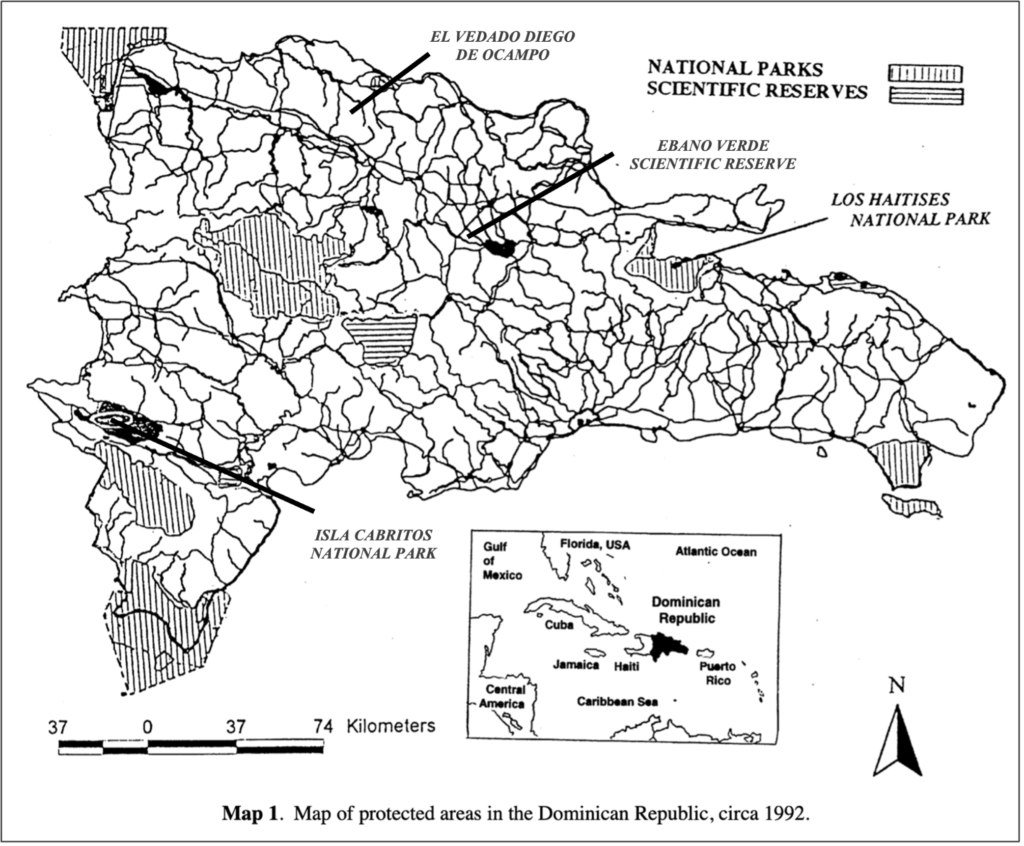

- The projects included a site to be reforested, a wildlife and eco-tourism resort to be developed (Isla Cabritos National Park), a reserve of scientific interest to be managed by a foundation of businessmen (Ebano Verde), a trail and education program to be implemented (El Vedado Diego de Ocampo)(see Map 1; UPI, 1990; Chantada, 1992).

- The protected areas did not consider farmers. They repelled neighbouring communities as the boundaries were disputed. According to a civil servant, „in none was the community consulted, and many ended up displacing sizeable populations that were inside or next to the parks that were created, without studies, without consulting, without compensation, without any of this“ (Holmes, 2010, p.634).

- Farmers had to revert to more excessive practices on some of the land. Officials ordered the eviction of 3,000 of them from the central mountain region to protect the river basins (Chantada, 1992).

- At the Isla Cabritos National Park, managed by a firm, the crocodile population had dropped from 500 to 60, the price for a fare to the island had risen from 20 to 1,750 pesos, instead of a museum a dam was constructed, and plans for a hotel were released (Chantada, 1992).

- The businessmen in the Ebano Verde project sold a minor part of the land, the proceeds of which went to the National Parks Directorate, and a greater part on the market free of tax (Chantada, 1992).

- The state discharged a first part of its debt (US$ 580,000 in face value), anticipating further swaps (up to US$ 80 million). In exchange, Pronatura, a trust formed by 11 Dominican conservation NGOs, got funded for the projects (Dogse/Droste, 1990; UPI, 1990).

Source: Geisler et al., 1997, adapted.

Context

At that time, the DR was at the brink of economic and ecological “bankruptcy” (Chantada, 1992). On the one hand, as with many Latin American countries, the DR had undergone a period of agriculture and industry-led growth since the 1960s. The state had heavily borrowed for large-scale infrastructure projects and relied on extractive, resource-intense exports to make ends meet (Patterson, 1990; Holmes, 2010; Burnett, 2016). External debt had risen to US$ 4.5 billion, i.e., around half the size of the economy (UPI, 1990; Chantada, 1992).

On the other hand, a fifth of the country had been declared as protected by the 1990s for which it is praised by conservationists. Critics argue that conservation has been driven by elites. During the 1930-60s dictatorship of Rafael Trujillo it allowed to plunder timber. Subsequent conservation by president Joaquín Balaguer was led by clientelism „rather than environmental convictions“ (Holmes, 2010, p.632). An environmental ministry did not exist until the 2000s—there were no policies on other issues such as pollution. In effect, the political elite pushed the country to its fiscal and ecological limits (Chantada, 1992).

Causes

Discursive, institutional, and economic powers exploited the opportunity to exchange debt for conservation, which monetized nature for some, and created injustices for others.

Development banks, agencies, and their sponsor states welcomed, and soon engaged in, debt swaps as they allowed them “to co-opt environment-related challenges to modernizing development“ (McAfee, 1999, p.136; cf. Dogse/Droste, 1990; Patterson, 1990). The DR swap aligned with the environmental economic paradigm as it seemingly conserved global public goods (e.g. crocodiles) and funded global benefits (e.g. restored forest). This sanctioned the intervention.

The Nature Conservancy exercised its economic powers as it purchased the dept papers for 15 cents a dollar (of US$ 582,000 in face value). Transferring them through the Conservation Trust of Puerto Rico, a vehicle, it had them exchanged by the DR central bank into local conservation funds at par (i.e. the equivalent of the face value in pesos). Nature Conservancy benefitted from a discount and “leveraged” its investment (Dogse/Droste, 1990, annex 2; UPI, 1990). It also promoted its work, services, and reputation (Holmes, 2010). Commercial banks participated to dump the toxic debt papers (Occhiolini, 1990). Markets contributed in two ways: nature is marketed to eco-tourists (e.g. Isla Cabritos); speculators exploited opportunities that arose from newly created price differentials (e.g. selling land in Ebano Verde, trading debt papers).

The political and quasi-political (oligarchic) elites dominated conservation in the DR. The debt swap amplified it. Because of the central authority and the clientelism of the government, the Dominican elites enjoyed privileges. They exercised institutional powers directly or indirectly, masked by the state apparatus. They established Pronatura which participated in the swap and was entitled to the conservation funds and administration (UPI, 1990).

Repercussions from Swapping Debt for Nature: Local Powerplays Shaping Conservation

Outcomes

Well-networked local elites arranged conservation in their favour and defended their monopoly against foreign powers. Social movements contested the swap and helped bring further conservation from it to a halt.

- Using Pronatura as a trust in the swap and their connections, local conservationists prevented the Nature Conservancy from playing an active role. They covertly co-opted environmental groups to add credence to their venture (Holmes, 2010).

- Nature Conservancy, after several failed attempts to purchase or manage protected areas, reverted to window dressing with respect to its role in the DR (Holmes, 2010).

- Soon after the initial projects, the conversion program phased out (at US$ 27 million). Most of the projects that the parties had agreed on did not commence. This is despite the swap arrangement having foreseen further conservation (up to US$ 80 million in face value) (Dogse/Droste, 1990; Chantada, 1992).

- Environmental movement groups opposed the swap and voiced fierce resistance against the new conservation projects. However, the program also created divisions among some of the groups that had previously united in the ‚Federación Dominicana de Asociaciones Ecológicas‘ (Chantada, 1992).

- Environmentalists generally opposed conservationists’ neoliberal privatization of parks and beaches; capitalist forestation (e.g. eucalyptus); and ignorance of industrialized agriculture and mining (Chantada, 1992; Holmes, 2010).

- They criticized local conservation NGOs affiliated with Pronatura for deforesting protected areas in the central mountain region (i.e., where the government had evicted farmers) (Chantada, 1992; Geisler et al., 1997).

- They denounced conservation elites for evading income tax by misusing the non-profit status of NGOs in their forestry business (Chantada, 1992).

- They decried the state, distracted by parks, for neglecting other issues: In Haina, a town next to Santo Domingo, 90% of the residents got lead poisoned from a factory (Holmes, 2010).

- A regime change in 1996 may have contributed to ending swaps. The NGO business was highly politicized along party lines. As competition among parties, hence NGOs increased, the conservationists’ power fluctuated (Holmes, 2010).

- Transnationally, NGOs have continued capitalist conservation and remain “too powerful and well connected to be held accountable” (Holmes, 2010, p.637).

- Researchers unveiled: “The prevailing discourse of conservation policy in … Latin American countries has frequently presented protected areas as benefiting local communities … in receiving programmes for combining economic development with conservation of natural resources, as part of the policy of ‘sustainable development’…. To the contrary, we discovered that external actors with economic power (commercial tour agencies, eco-developers, and hotel owners) are in the process of becoming the primary beneficiaries” (Berlanga/Faust, 2007, in Igoe/Brockington, 2007, p.441)

Context

There has historically been a widespread opposition in the DR, as in many Latin American countries, against hegemonic influence from the North. Conservation, or land appropriation, by foreign NGOs represented an attack on state sovereignty. Debt swap proposals from abroad were initially opposed by the elites and media. This opposition not only united the Dominican conservationists (Patterson, 1990; Holmes, 2010). It may have been the only thing the government, elites, and social movements had in common.

Internationally, the elitist notion emerged that the world’s poor cannot but degrade their natural wealth. „Nature as a global currency“ (McAfee, 1999, p.142) was supposed to break the vicious cycle of debt and unsustainable development since “free-markets and the commodification of nature will produce outcomes that benefit everyone“ (Igoe/Brockington, 2007, p.446). Social movements in the DR recognized that the North imposed upon them a role that they had to play in this narrative: freeze development, avoid similarly disastrous industrialization, and preserve the planet for them (Chantada, 1992).

Causes

Local and international non-state actors competed for preserving or using the environment according to their motives. Local elites repelled foreign conservationists. Organized in NGOs, oligarchs and politicians resisted Nature Conservancy with which they competed for economic interests. They internalized the capitalist conservation ideologies, however, and influenced the government. Nature Conservancy, supported by aid, contended for the justification of its existence, its business model: funding itself, advocacy, eco-tourism (Holmes, 2010).

Environmental groups fought capitalist conservation practises due to the ecological injustices. Organized in an association, they opposed foreign conservationists for fear of land grabbing. They were left out from the swap arrangement but felt taken hostage as “accomplices” of Pronatura to justify the program. They disapproved of the swap and privatization since they gave way for extractive businesses by elites and left out the majority peasants (Chantada, 1992).

Conclusion

“There is no free lunch” is an early lesson in finance. In a market setting, someone always bears the cost. In an environmental injustice, some profit. As green developmentalism shifts nature into the market economy, finding out who benefits and who loses becomes a quest.

I argue that debt swaps are a spatiotemporal transformation of debt by way of which powerful elites monetize the environment and socialize the costs. The Dominican Republic’s case shows that debt-for-nature swaps distort access to the environment by creating exclusive rights for some and scarcity for many.

Having investigated the country’s swap from 1990, I expose how financial debt is transformed into material debt (both physical and vital). First, debt—not all, but some—is outsourced under the disguise of conservation. I.e., parts went off the books of the state, creating (de jure) environmental assets for—in this case—Dominican elites and reducing (de facto) the subsistence of residents.

Second, over time, the conservationists extract gains from the environment, paid for by its residents as they cope with exclusion, displacement, and degraded ecosystems possibly for a lifetime. I.e., the Dominican elites now also have (de facto) an environmental liability, a loan which they (de jure) never have to repay. This is how costs are socialized, the environment monetized. This I call “shapeshifting”. These are the injustices from swapping debt for nature.

The case also lays out the relations and motives of the discursive, economic, and institutional powers involved. It confirms that these contain the “international political-economic status quo”; “marginalize countries and movements that insist on pursuing subversive interpretations of” sustainable development; and aim to “socialize environmental costs globally” (McAfee, 1999, p.3/136).

Conservation in the DR has been a contested issue before and after the swap. The fault lines evolved between national elites, transnational conservationists—both similar in their approach, and environmental movements. Further conservation from the debt program itself ended as resistance rose, and clientelist support waned.

This is important given the resurgence of swaps. What has changed between then and now is mainly that the environment and development discourse has centred on the climate (Hulme, 2011). Debt-for-climate swaps may as well fuel environmental injustices.

Bibliography

Bedarff, H., Holznagel, B., Jakobeit, C. (1989): Debt-for-Nature Swaps: Environmental Colonialism or a Way Out from the Debt Crisis that Makes Sense? In: Verfassung und Recht in Übersee / Law and Politics in Africa, Asia and Latin America, 4. Quartal, 1989, Vol. 22, No. 4, pp.445-459.

Berlanga, M., Faust, B.B. (2007): We Thought We Wanted a Reserve: One Community’s Disillusionment with Government Conservation Management. In: Conservation and Society, Volume 5, No. 4, 2007, pp.450-470.

Bolton, B., Buchheit, L.C., di Mauro, B.W., Panizza, U., Gulati, M. (2022): Environmental protection and sovereign debt restructuring. In: Capital Markets Law Journal, 2022, Vol. 17, No. 3, pp.307-316.

Bracking, S. (2019): Financialisation, Climate Finance, and the Calculative Challenges of Managing Environmental Change. In: Antipode, Vol. 51, No. 3, 2019, pp. 709-729.

Bracking, S. (2021): Climate Finance and the Promise of Fake Solutions to Climate Change. In: Böhm, S. / Sullivan, S. (eds), Negotiating Climate Change in Crisis. Cambridge, UK: Open Book Publishers, 2021, pp.255-276.

Brockington, D., Duffy, R. (2010): Capitalism and Conservation: The Production and Reproduction of Biodiversity Conservation. In: Antipode, Vol. 42, No. 3, 2010, pp.469-484.

Brodbeck, N., Kaiser, J., Kopper, E., Rehbein, K., Schilder, K., Stutz, M. (2022): Global Sovereign Debt Monitor 2022. Available at: https://www.cadtm.org/Global-Sovereign-Debt-Monitor-2022 (accessed on December 19, 2022).

Burnett, M.T. (2016): Natural Resource Conflicts: From Blood Diamonds to Rainforest Destruction: From Blood Diamonds to Rainforest Destruction. Voorkant.

Cassimon, D., Prowse, M., Essers, D. (2011): The pitfalls and potential of debt-for-nature swaps: A US-Indonesian case study. In: Global Environmental Change 21, 2011, pp.93-102.

Chamon, M., Klok, E., Thakoor, V., Zettelmeyer, J. (2022): Debt-for-Climate Swaps: Analysis, Design, and Implementation. IMF Working Paper 2022/162, International Monetary Fund, Washington, DC.

Chantada, A. (1992): Los canjes de deuda por naturaleza. El caso dominicano. In: Nueva Sociedad Nro.122, Noviembre-Diciembre, 1992, pp.164-175.

Dogse, P. Droste, B (1990): Debt-for-nature exchanges and biosphere reserves: experiences andpotential. MAB Digest 6. Unesco. Paris.

Essers, D., Cassimon, D., Prowse, M. (2021): Debt-for-climate swaps in the COVID-19 era: Killing two birds with one stone? Available at: https://ideas.repec.org/p/iob/apbrfs/2021001.html (accessed on December 19, 2022).

Geisler, C., Warne, R., Barton, A. (1997): The wandering commons: A conservation conundrum in the Dominican Republic. In: Agriculture and Human Values, 14, 1997, pp. 325–335.

Goldman, M. (2001): Constructing an EnvironmentalState: Eco-governmentalityand other Transnational Practices of a ‘Green’ WorldBank. In: Social Problems, Vol. 48, No. 4, pp.499-523.

Hansen, S. (1989): Debt for nature swaps – Overview and discussion of key issues. In: Ecological Economics, 1, pp.77-93.

Hassoun, N. (2012): The Problem of Debt-for-Nature Swaps from a Human Rights Perspective. In: Journal of Applied Philosophy, Vol. 29, No. 4, 2012, pp.359-377.

Hawkins, A.P. (1990): Swapping Debt for Nature: Emergence of a New Global Structure? Ph.D. Dissertation. Cornell University.

Holmes, G. (2010): The Rich, the Powerful and the Endangered: Conservation Elites, Networks and the Dominican Republic. In: Antipode, Vol. 42, No. 3, 2010, pp.624-646.

Hulme, M. (2011): Reducing the Future to Climate: A Story of Climate Determinism and Reductionism. In: OSIRIS, 26, 2011, pp.245-266.

Igoe, J., Brockington, D. (2007): Neoliberal Conservation: A Brief Introduction. In: Conservation and Society, Volume 5, No. 4, 2007, pp.432-449.

Kay, K. (2017): A Hostile Takeover of Nature? Placing Value in Conservation Finance. In: Antipode, Vol. 50, No. 1, 2018, pp. 164–183.

Lewis, A. (1999): The Evolving Process of Swapping Debt for Nature. In: Colo. J. Int’l Envtl. L. & Pol’y, Vol. 10, 2, pp.431-467.

McAfee, K. (1999): Selling nature to save it? Biodiversity and green developmentalism. In: Environment and Planning D: Society and Space, 1999, Vol. 17, pp.133-154.

Occhiolini, M. (1990): Debt for nature swaps (English). Policy, Research, and External Affairs working papers, no. WPS 393, Washington, D.C.: World Bank Group. Available at: http://documents.worldbank.org/curated/en/300181468739253960/Debt-for-nature-swaps (accessed on December 19, 2022).

OECD (2007): Lessons Learnt from Experience with Debt-for-Environment Swaps in Economies in Transition. Available at: https://www.oecd.org/environment/outreach/39352290.pdf (accessed on December 19, 2022).

Owen, N. (2022): IMF Country Focus. Belize: Swapping Debt for Nature. Available at: https://www.imf.org/en/News/Articles/2022/05/03/CF-Belize-swapping-debt-for-nature (accessed on December 19, 2022).

Patterson, A. (1990): Debt-for-Nature Swaps and the Need for Alternatives. In: Environment, December, 1990, pp.4-32.

Pellow, D.N. (2001): Environmental Justice and The Political Process: Movements, Corporations, and the State. In: The Sociological Quarterly, Vol. 42, No. 1, pp.47-67.

Rambarran, J. (2018): Debt for Climate Swaps: Lessons for Caribbean SIDS from the Seychelles’ Experience. In: Social and Economic Studies, 67: 2 & 3, 2018, pp.261-291.

Rosebrock, J., Sondhof, H. (1991): Debt-for-Nature Swaps: A Review of the First Experiences. In: Intereconomics, March/April, 1991, pp.82-87.

Silver, J., Campbell, L. (2018): Conservation, development and the blue frontier: the Republic of Seychelles’ Debt Restructuring for Marine Conservation and Climate Adaptation Program. In: International Social Science Journal, September 2018, pp.1-16.

Singh, D., Widge, V. (2021): Debt for Climate Swaps. Supporting a sustainable recovery. Climate Policy Initiative. Available at: https://www.climatepolicyinitiative.org/wp-content/uploads/2021/05/Debt-for-Climate-Swaps-Blueprint-May-2021.pdf (accessed on December 19, 2022).

Steele, P., Patel, S. (2020): Tackling the triple crisis. Using debt swaps to address debt, climate and nature loss post-COVID-19. International Institute for Environment and Development. Available at: https://www.jstor.org/stable/resrep29077#metadata_info_tab_contents (accessed on December 19, 2022).

Thapa, B. (1998): Debt-for-nature swaps: an overview. In: The International Journal of Sustainable Development & World Ecology, 5:4, pp.249-262.

Thomas, A., Theokritoff, E. (2021): Debt-for-climate swaps for small islands. Nature Climate Change, Vol. 11, November, 2021, pp.889–893.

UNEP (2022): What you need to know about the COP27 Loss and Damage Fund. Available at: https://www.unep.org/news-and-stories/story/what-you-need-know-about-cop27-loss-and-damage-fund (accessed on December 19, 2022).

UPI (1990): Dominican Republic announces largest debt-for-nature swap. Available at: https://www.upi.com/Archives/1990/03/02/Dominican-Republic-announces-largest-debt-for-nature-swap/8084636354000/ (accessed on December 19, 2022).

Yue, M., Wang, C.N. (2021): Debt-For-Nature Swaps: A Triple-Win Solution for Debt Sustainability and Biodiversity Finance in the Belt and Road Initiative? Green BRI Center, International Institute of Green Finance (IIGF), Beijing.

Leave a Reply